Specialized or modified car insurance is often the best way to protect a customized vehicle

Customized sportscars, tricked-out muscle cars and modified luxury cars can differ a lot from the original models that rolled off the factory floor.

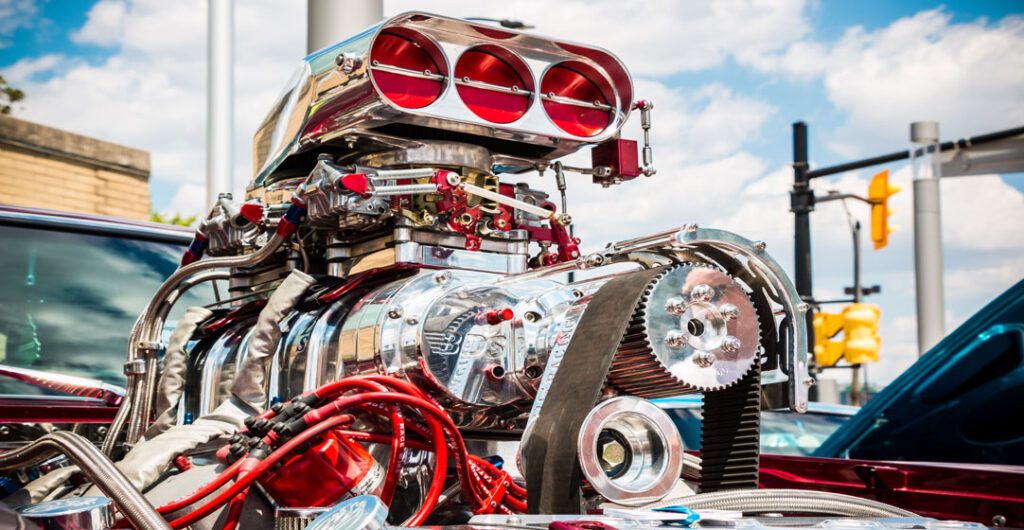

So does the car insurance that you might need to protect them. If you own a customized vehicle, like a bagged Toyota Camry or a muscle car with a stacked engine on the hood, you’ll often need modified car insurance.

Standard auto policies don’t naturally fit many modified car and truck types. If you do manage to include modified or customized car on a standard auto policy, you could wind up underinsured for damage or pay too much for an inefficient policy.

What is modified car insurance?

Insurance for custom or modified vehicles is written for a wide range of cars and trucks that are difficult (or impossible) to insure with a standard auto policy. These include newer cars that are modified and customized by the owners, like street rods, exotic cars and trucks, kit cars and replicas with tricked-out additions, as well as a range of other more traditional collector car types, like classic, vintage and antique cars.

How is modified car insurance different?

Insurance for modified and custom cars differs from regular auto insurance in three major ways:

- The vehicle must be intended for pleasure-use only; it can’t be used as a primary vehicle. For example, you can’t commute in it.

- The vehicle has an agreed upon replacement value, such as $25,000, that doesn’t go down over time.

- All policies are customized; no policy is exactly alike.

Tip: AAA Washington agents can help you get car insurance for modified and customized vehicles through modified car insurance companies, including Hagerty and American Modern, which both specialize in insuring hard-to-fit car and truck types. These companies write custom policies for all types of collectible vehicles. Call AAA Washington to learn more about your options and to get the best insurance for modified cars.

When should I get custom or modified car insurance?

Some modified and custom vehicles fall into a grey area. Lots of people, for example, own sports cars or muscle cars that have been modified with extra low suspension and tiny or extra fat tires, or are souped-up with turbo engines and extra horsepower. However, the owners drive the cars regularly, or use them as their primary vehicle to get around. These owners would likely have to insure these with a standard auto policy.

Generally speaking, modified car insurance insurance is a better fit for customized vehicles that are used as hobby cars or for pleasure-use only. Standard insurance has a hard time capturing the value of the improvements and custom features. You would be a good candidate for specialized or modified car insurance if you check these boxes:

- Your vehicle was purchased for a hobby or as an investment;

- You rarely drive the car; you mostly take it to car shows, meet-ups or out for a weekend drive;

- It is stored mostly in an enclosed garage;

- The car’s value is stable or going up over time;

- The car requires custom-manufactured or hard-to-find parts.

What does specialized car insurance cover?

A policy that covers a modified or custom vehicle offers the same major coverage categories as a regular auto policy. (Note that in Washington and Idaho, you need to keep a minimum level of liability insurance on any vehicle before you can drive it legally.)

The major types of auto insurance include:

- Liability insurance will cover you in case you injure another person or their property and are found to be at fault for the injuries or damage;

- Collision insurance will cover the damage to your vehicle in case you are in an accident with another vehicle, experience a rollover or hit a fixed object, like a guardrail;

- Comprehensive coverage will cover damage that is out of your control, such as a collision with wildlife, storm damage, theft and vandalism.

Can I insure a racecar?

Yes, it’s possible to insure a racecar via AAA Washington’s partner, Hagerty. Hagerty will write custom policies for racecars, just as they would for a custom or modified car. Hagerty will also insure racecars and other high-performance vehicles when they are on a track. For track days, you must obtain a separate, short-duration policy. These policies are designed for high-performance driver education events, not for competitive wheel-to-wheel racing.

Know the 5 key differences of modified car insurance

1. You always keep damage protection

Unlike regular cars and trucks that start losing their value almost immediately, customized and modified cars tend to hold their value, and can increase in value as time passes.

So, you will always keep collision and comprehensive insurance to cover any damage to the vehicle. By contrast, owners of new cars and trucks usually drop the damage coverage on standard auto policies after a certain number of years. Typically, you would drop the damage coverage after five years or 100,000 miles, or when the car’s value has dropped to a point where it makes little sense to carry the extra insurance.

2. You get an agreed upon value

Policies for custom and modified cars also work differently in how they treat the replacement value of the car. When the modified car insurance policy is written, the owner and the insurance company will assign “an agreed value” to the vehicle. Normally, the owner has a lot of flexibility in calculating the car’s worth. Once the value is accepted by the insurer, it will pay that amount if the car is totaled. So, if the car is insured for $20,000 and it is a total loss, the owner will receive a check for $20,000 to replace the car.

By contrast, standard auto policies usually pay what is known as “actual cash value,” which accounts for the car’s depreciation—its estimated value on the day it’s totaled. A new car begins losing value once it leaves the sales lot. If a car is totaled after five years, the insurer will pay far less than the vehicle’s original purchase price.

3. No two modified car insurance policies are the same

No two modified or custom vehicles are exactly the same. Each is unique and has its own value. So, the policy has to be much more flexible than a typical auto policy. It is written specifically for the features of the modified or custom car.

4. You can adjust the damage coverage

You can change the insured value of the car after it has undergone restoration or modification. For example, when you are customizing or restoring the vehicle, the agreed value could be $10,000, then increased to $25,000 when the restoration is complete.

5. Modified car insurance can be more affordable

Insurance for modified or custom vehicles often costs less than a regular auto policy that includes collision and comprehensive insurance. That’s because the modified car is only intended for occasional use. The premiums will depend on the value of the car and the liability limits, however.

Additional car insurance options

You can also often add other useful insurance to your policy, including:

- Coverage to keep a totaled car. If your customized or modified car is a total loss, typically you will have to surrender the car to a salvage yard. If you want to keep a damaged vehicle, you must pay the salvage value. For example, you might have to pay $2,000 to keep the wrecked vehicle, which would be taken out of the payment you receive from the insurance company to replace it. However, you can sometimes add-on insurance that will allow you to keep the salvaged vehicle at no cost.

- Coverage for tools. You can insure your tools for modifying or restoring a car.

- Add additional coverage for spare parts. While some policies automatically provide a small amount of coverage for stored spare parts (around $750), it is often possible to increase this coverage.

Tip: AAA Washington members can save up to 8% on insurance. Click here to learn how.

Are there special conditions to apply for modified car insurance?

Yes, there can be. To write a policy, the insurer will ask questions about the car and the household. They typically will want to know:

- The ages of all the people who would be authorized to drive the car. Most insurance companies impose age restrictions on who can drive the vehicle.

- Drivers who are new to high horsepower vehicles can expect to be asked questions about their driving experience.

- The driving records of the insured individuals. Normally, you must have a clean driving record with no major violations for three years.

- To ensure that the collectible vehicle is not going be used as a primary vehicle, some insurers require that all members of the household have their own vehicles. So, to add a policy for a modified or customized car in a household with two licensed drivers, you would have to have two other primary vehicles.

- The storage location. Most insurers prefer that the car is stored in a covered garage or storage facility but, in some cases, carports with a roof are OK.

Modified car insurance is a great option for anyone who owns a customized vehicle that’s hard to fit into a standard auto policy. If you are not quite sure what you need for your ride, call a AAA Washington agent today.

—Written by AAA Washington staff

—Top photo: AdobeStock